Top 5 Threats to Carrier Capacity in 2017

1. Electronic Logging Devices

The ELD mandate is now less than one year away. That means that after December 17, 2017, all heavy-duty trucks (with a few exceptions) must use electronic logging devices (ELDs) to log their hours of service. While some carriers have been using ELDs for years, many small fleets and owner-operators have yet to make the switch from paper logs. Industry predictions about the reduction of capacity following the mandate vary from 3-5 percent, to 6-10 percent.

2. Increased scrutiny of drivers

In a time when truck drivers are already hard to find and retain, there are several new regulations under consideration by the FMCSA that could further chip away at the number of drivers. There are proposals to test drivers for sleep apnea, use hair testing to check for drug use, and to create a database of drivers who have failed a drug or alcohol test. While this is good for the industry as a whole, experts expect to see declines in compliant drives to be between 5-10 percent.

3. Speed Limiters

The FMCSA recently completed public comment on a speed limiter rule that could force drivers to drive slower than the posted speed limit in certain states. A reduction of even a few miles per hour, multiplied by the thousands of miles a driver logs each year, would be a significant hit to productivity. This reduction in revenue combined with carriers who are currently struggling to stay in business could result in significant loss of capacity from predominately smaller carriers who add liquidity and price relief in many lanes and especially in tight markets.

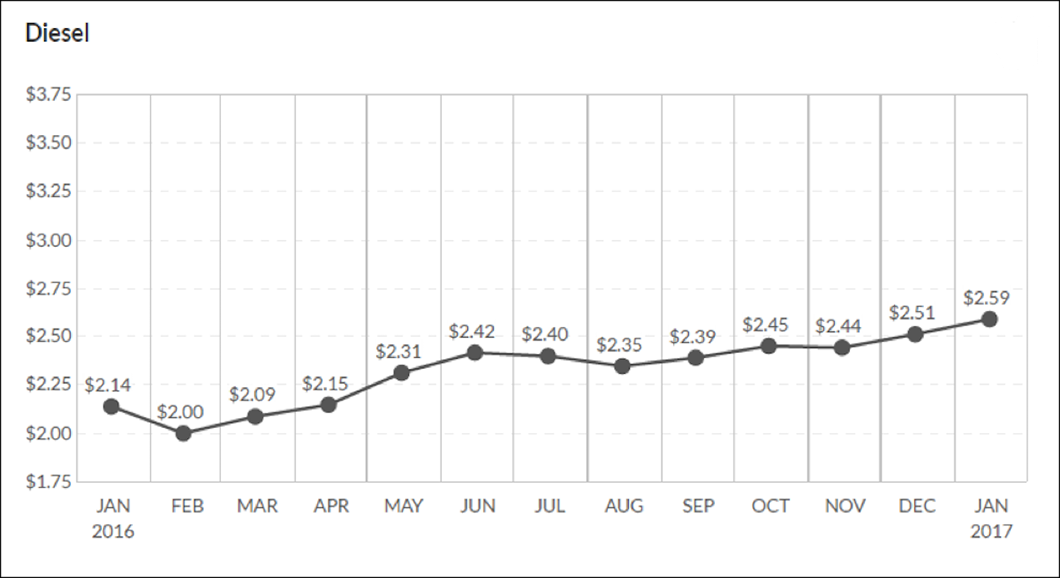

4. Rising fuel prices

Diesel prices have risen 59 cents per gallon since February, and analysts are predicting prices to continue to rise in 2017. The Organization of Petroleum Exporting Countries (OPEC) announced that they plan to cut production this year and, at current prices, there's not much incentive to increase U.S. oil production.

For carriers, the cost of fuel is their second-highest expense, behind personnel costs. When fuel prices rose sharply in 2008, the number of carrier bankruptcies also spiked. Fleets and owner-operators who have hobbled along financially while prices have been low, could be pushed over the edge if fuel prices rise significantly.

National average diesel prices have climbed 59 cents per gallon since February.

5. Strong Demand

The volume of available freight has increased for 6 straight months starting back in July of 2106. Reefer demand has seen a 55% increase year over year and is projected to continue to increase into 2017. While these increases have been mostly absorbed by previously loose carrier capacity, data suggests the increased demand combined with tightening carrier capacity may exert the greatest upward pricing pressure on lanes that experience peak seasonal volumes.

Managing Member

Columbia Fresh Transportation Services

Call now to find out what Columbia Fresh Transportation Services can do for your business

CALL 800-873-1236 FAX 503-477-6121 E-MAIL sales@columbiafreshtrans.com

ADDRESS Columbia Fresh Transportation Services, 4931 SW 76th Ave #368, Portland, OR 97225